Take advantage of New York Community Bank promotions, bonuses, and offers here!

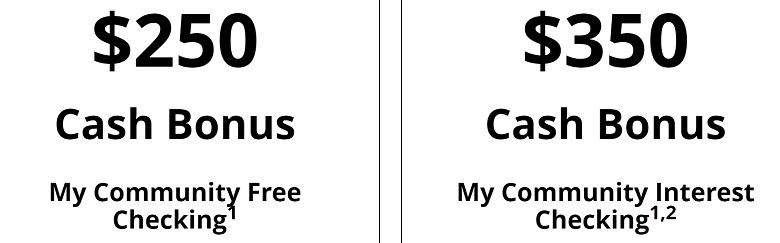

Currently, the bank is offering $250, $350 bonus when you sign up for a new checking account and meeting all the requirements.

About New York Community Bank Promotions

New York Community Bancorp, Inc. is the parent company of Flagstar Bank, N.A., one of the largest regional banks in the country. The Company is headquartered in Hicksville, New York with regional headquarters in Troy, Michigan. At March 31, 2023, the Company had $123.8 billion of assets, $83.3 billion of loans, deposits of $84.8 billion, and total stockholders’ equity of $10.8 billion.

Flagstar Bank, N.A. operates 435 branches, including strong footholds in the Northeast and Midwest and exposure to high growth markets in the Southeast and West Coast. Flagstar Mortgage operates nationally through a wholesale network of approximately 3,000 third-party mortgage originators.

New York Community Bank $350 Checking Bonus

Earn a $250 or $350 bonus when you open a new checking account and meet the qualifying requirements.

- What you’ll get: $250 or $350 bonus

- Account Type: Checking

- Availability: AZ, FL, MI, NJ, NY, OH (Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: None

- Monthly Fees: $2-$6; see below

- Early Account Termination Fee: Not listed

- Household limit: None listed

(Expires 12/30/2023)

| BMO Smart Money Checking ($300 cash bonus) | BMO Smart Advantage Checking ($300 cash bonus) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| Fifth Third Bank Momentum® Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | Truist Checking ($400 bonus) |

How To Earn Bonus

- Open a My Community Free Checking account with $1 or more or a My Community Interest Checking account with $100 or more.

- Earn a $250 cash bonus with the My Community Free Checking

- Earn a $350 cash bonus with the My Community Interest Checking

- Maintain an average daily balance of $500 or more for the first 90 days. AND

- Have one or more direct deposits (ACH credits) totaling $500 or more in the first 90 days.

- You will receive a bonus credit in your new account 91 – 104 days after the account’s initial funding.

- The bonus offer applies to new consumer checking customers only and to new My Community Free Checking accounts opened with $1.00 or more or My Community Interest Checking opened with $100.00 or more during the promotional period.

- A bonus credit of $250.00 for My Community Free Checking or $350.00 for My Community Interest Checking will be rewarded 91-104 days after an initial deposit made to the new account (account funding) opened and within 90 calendar days of the account funding (bonus period) the following occurs: 1) maintain an average daily balance of $500.00 or more; AND 2) have one or more direct deposits (ACH credits) totaling $500.00 or more.

- This offer is limited to one checking bonus per household.

- Reclamation of bonus may be imposed for accounts closed within 180 days.

- Flagstar Bank, N.A. employees and officers are not eligible for this offer.

- If you have been paid a checking cash bonus previously, you are ineligible to receive this offer.

- Receiving this offer does not guarantee your eligibility.

- All account applications are subject to our normal approval process.

- Area restrictions may apply.

- For tax purposes, at the end of the year you will receive an IRS form from Flagstar Bank, N.A.

- Bonus will be reported as interest income.

- Offer subject to change or cancellation at any time without notice.

How To Waive Monthly Fee

- My Community Basic Checking: $2.00 monthly maintenance fee

- My Community Free Checking: No monthly fee when enrolled for e-Statements

- My Community Interest Checking: $6.00 monthly fee when daily balance is below $500.00

- My Community 50+ Checking: $5.00 monthly fee when daily balance is below $1,000.00

- Business Solutions Checking: $15.00 monthly fee with balance* between $0 – $999.99

- 10.00 with monthly fee with balance between $1,000.00 – $2,999.99

- $0 with balance of $3,000 or $10,000 combined in eligible linked accounts

- Business Solutions Checking with Interest: $15.00 monthly fee with balance* between $0 – $999.99

- 10.00 with monthly fee with balance between $1,000.00 – $2,999.99

- $0 with balance of $3,000; or $15,000 combined in eligible linked accounts

- Business Solutions Analysis Checking: $25 monthly fee can be offset with an earnings credit

- The earnings credit is applied to the average collected balance (less 10% reserve requirement) and is applied towards offsetting the account’s monthly transaction fees?.

- Business Solutions Analysis Checking with Interest: $25 monthly fee can be offset with an earnings credit

- The earnings credit is applied to the average balance (less 10% reserve requirement) and is applied towards offsetting the account’s monthly transaction fees?.

|

|

Bottom Line

If you live near a New York Community Bank location, you have the opportunity to earn generous bonuses. To earn these bonuses, simply open the eligible accounts and follow the procedures and the bonuses shall be granted!

Although you can earn a generous bonus from New York Community Bank, check out our list of bank promotions for more offers. With fantastic offers such as Money Market and CD rates, you are able to get the most out of your banking experience!

Compare New York Community Bank Promotions with other bank bonuses from banks like U.S. Bank, Citi, Huntington, HSBC, Chase, TD Bank, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, and more!

Went in to open account the other day and doesn’t appear to be hard pull