Find all the current Village Bank & Trust promotions, bonuses, and offers here.

For Illinois residents, find the latest Village Bank & Trust promotions & bonuses with offers ranging from $200, $300, $500+ when opening a new bank account.

Update 3/29/24: The checking and savings bonus offers have been extended through 1/29/25.

About Village Bank & Trust Promotions

Village Bank & Trust is headquartered in Arlington Heights, IL. It was established in 1995 and has grown to have 94 employees at 10 locations as of March 2021.

I’ll review the offers below.

Village Bank & Trust $500 Checking & Savings Bonus

Earn a $500 bonus at Village Bank & Trust!

Village Bank & Trust is offering new members a $500 bonus when they open a new checking account and statement savings and meet the requirements.

- What you’ll get: $500 bonus

- Account Type: Checking and Savings Account

- Availability: IL (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Unknown

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Termination Fees: None listed, check with CSR for more information

- Household limit: One

(Expires 01/29/2025)

| BMO Smart Money Checking ($300 cash bonus) | BMO Smart Advantage Checking ($300 cash bonus) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| Fifth Third Bank Momentum® Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | Truist Checking ($400 bonus) |

How To Earn $500 Bonus

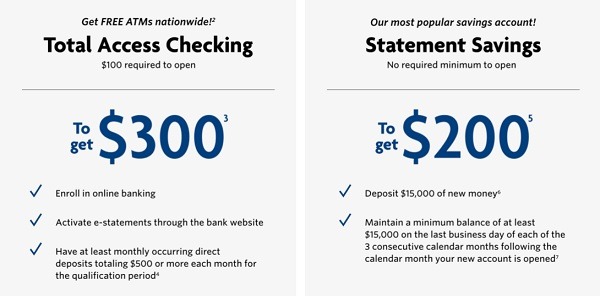

- In order to get the $300 bonus:

- Open a Total Access Checking

- Enroll in online banking

- Activate e-statements through the bank website

- Have at least monthly occurring direct deposits totaling $500 or more each month for the qualification period

- In order to get the $200 bonus:

- Open a Statement Savings account

- Deposit $15,000 of new money

- Maintain a minimum balance of at least $15,000 on the last business day of each of the 3 consecutive calendar months following the calendar month your new account is opened

- General Bonus Information. Offers valid for accounts opened 2/1/24 — 1/29/25. Offers not available to existing or closed checking/savings account customers of Wintrust Financial Corporation (‘WTFC’) & its subsidiaries or employees. Limit 1 bonus payment per customer, regardless of number of accounts opened; may only be received from 1 WTFC location. Total Access Checking offer combinable with any WTFC savings offer; Statement Savings offer combinable with any WTFC checking offer. Bonus payment subject to IRS 1099-INT reporting & may be considered income for tax purposes.

- Total Access Checking Bonus Qualifications. (i) Open new Total Access Checking account; (ii) mention offer during in-branch account opening, visit URL provided, or enter Echecking300 when applying online; (iii) have direct deposits totaling at least $500 per month made to the new account for 2 consecutive calendar months after the calendar month the new account was opened (‘Qualification Period’); & (iv) enroll in online banking & e-statements within the Qualification Period. Direct deposit is a payment made by a government agency, employer, or other third-party organization via electronic deposit, but does not include teller/ATM/mobile or remote deposits, wire transfers, digital banking/telephone transfers between accounts at WTFC, external transfers from accounts at other financial institutions, peer-to-peer network payments like Zelle® or Venmo, or debit card transfers & deposits. New account must be open & have a balance greater than $0 at time of bonus payment. Balance determined as of end of each business day as funds currently in the account including deposits & withdrawals made in the business day. For eligible customers, bonus is deposited into the new account within 30 calendar days after the Qualification Period. A listing of WTFC locations can be found here: wintrust.com/locations.

- Statement Savings Bonus Qualifications. (i) Open new Statement Savings account; (ii) mention offer during in-branch account opening, visit URL provided, or enter Esavings200 when applying online; (iii) deposit $15,000 or more of new money (defined as money not currently held at any WTFC location); & (iv) maintain minimum balance of at least $15,000 on the last business day of each of the 3 consecutive calendar months following the calendar month the new account is opened (‘Qualification Period’). New account must be open & have a balance greater than $0 at time of bonus payment. Balance determined as of end of each business day as funds currently in the account including deposits & withdrawals made in the business day. For eligible customers, bonus is deposited into the new account within 30 calendar days after the Qualification Period. A listing of WTFC locations can be found here: wintrust.com/locations.

Village Bank & Trust $300 Checking Bonus

Earn a $300 bonus at Village Bank & Trust!

Village Bank & Trust is offering new members a $300 bonus when they open a new checking account and meet the requirements.

- Account Type:

- Availability: IL

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Unknown

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Termination Fees: None listed, check with CSR for more information

- Household limit: One

(Expires 01/29/2025)

| BMO Smart Money Checking ($300 cash bonus) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | Fifth Third Bank Preferred Checking ($300 bonus) |

| HSBC Premier Checking (Up to $2,500 Cash Bonus), | |

How To Earn $300 Bonus

- Open a new Total Access Checking account now and get a $300 bonus when you:

- Have monthly occurring direct deposits totaling $500.00 each month made to your new account for 2 consecutive calendar months after the calendar month your new account was opened

- Enroll in online banking

- Activate e-statements within the Qualification Period.

- This Total Access Checking account bonus offer is not available to existing or closed checking account customers of Wintrust Financial Corporation and its subsidiaries (WTFC) or its active employees.

- Limit one bonus payment per customer, regardless of the number of accounts opened.

- If you qualify for this Total Access Checking account bonus offer, you are ineligible to receive this Total Access Checking account bonus offer from any other WTFC location.

- If you qualify for any other WTFC savings offer it may be combined with this Total Access Checking account bonus offer.

- Your new account must be open, in the same product, and have a balance greater than zero to receive the bonus payment.

- The $300.00 bonus payment is subject to IRS 1099-INT reporting and may be considered income for tax purposes for the tax year in which the bonus was paid.

Village Bank & Trust $300 Business Checking Bonus (Expired)

Earn a $300 bonus at Village Bank & Trust!

Village Bank & Trust is offering new members a $300 bonus when they open a new checking account and meet the requirements.

- Account Type: Entrepreneur Checking

- Availability: IL

- Early account termination fee: Unknown

- Household limit: 1

(Expires December 31, 2021)

| Chase Business Checking ($300 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| U.S. Bank Business Checking ( $400 or $900 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Live Oak Bank Business Savings ($200 Bonus) |

| Axos Business Premium Savings ($375 Bonus) | Bluevine Business Checking ($300 Bonus) |

How To Earn $300 Bonus

- To get $300, open a new Entrepreneur Checking account by 12/31/21

- deposit and maintain $1,500 or more in new money,

- complete five qualifying transactions,

- enroll in online banking,

- and activate e-statements within the qualification period.

- Entrepreneur Checking Bonus Information. This Entrepreneur Checking account bonus offer is not available to existing or closed checking account customers of Wintrust Financial Corporation (WTFC) and its subsidiaries or its active employees. Limit 1 bonus payment per customer, regardless of the number of accounts opened. If you qualify for this Entrepreneur Checking account bonus offer, you are ineligible to receive this Entrepreneur Checking account bonus offer from any other WTFC location. If you qualify for any other WTFC savings offer it may be combined with this Entrepreneur Checking account bonus offer. Your new account must be open, in the same product, and have a balance greater than zero to receive the bonus payment. If you are a sole proprietorship or a single member LLC, the $300.00 bonus payment is subject to IRS 1099-INT reporting and may be considered income for tax purposes for the tax year in which the bonus was paid.

- Entrepreneur Checking Account Information. Performing over 75 monthly transactions requires $1,500 minimum average collected balance to avoid a $15 monthly fee.

- Entrepreneur Checking Bonus Qualifications. (i) Open a new Entrepreneur Checking account from January 1, 2021 through December 31, 2021; (ii) tell us you are aware of this Entrepreneur Checking account bonus offer at account opening; (iii) Maintain a minimum balance of at least $1,500.00 on each day of the last business day of the 2 consecutive calendar months after the calendar month your new account was opened (“Qualification Period”); (iv) Complete 5 qualifying transactions, defined as ACH debit, ACH credit, wire transfer and debit card transactions, within the Qualification Period; and (v) enroll in online banking and activate e-statements within the Qualification Period. After you have completed all the above bonus qualifications, we will deposit the bonus payment into your new account within 30 calendar days after the Qualification Period.

How To Waive Monthly Fees

- Total Access Checking: None

- Access Plus Checking: $10 monthly fee waived with $1,000 minimum daily balance or $2,500 average daily balance for the statement cycle.

- Premier Checking: $25 monthly fee waived with $10,000 average daily balance or $75,000 combined average relationship balance for the statement cycle.

- Cubs Checking: None

- White Sox Checking: None

- Student Checking: None

- Platinum Preferred Checking: $10 monthly fee waived with $1,000 minimum daily balance

- Money Smart Checking: None

- Statement Savings: $5 monthly fee waived with $200 daily minimum balance

- Money Market: $15 monthly fee waived with $2,500 minimum daily balance OR $5,000 average daily balance for the monthly cycle

- Junior Savers Statement Savings: No monthly fees while under age 22

- MaxSafe Money Market: None

- Entrepreneur Checking: More than 75 transactions, require a $1,500 minimum average collected balance to avoid a $15 monthly fee

- Business Community Checking: Minimum average collected balance of $5,000, otherwise $15 monthly fee

- Have It All Business Checking: Minimum average collected balance of $20,000, otherwise $25 monthly fee

|

|

Bottom Line

Through a wide range of features and accounts, you are able to better your financial experience. If you are in Illinois, visit your local Village Bank & Trust for more information!

Additionally, your feedback is highly appreciated and makes our site even better! Therefore, if you have experience with Village Bank & Trust, leave us a comment below letting us know how it went.

Definitely check out our list below as well as our list of best bank offers for more promotions!

*Compare the latest Village Bank & Trust Promotions to other bank bonuses from Chase, HSBC, Huntington, TD, Citi, Ally, Discover, CIT, and more!*

*Check back often for the latest Village Bank & Trust promotions, bonuses, and offers!

Leave a Reply